BREAKING: US manufacturing index collapses to lowest point in nearly 2 years as global stocks plummet

Friday, August 21, 2015 by usafeaturesmedia

http://www.nationalsecurity.news/2015-08-21-stocks-plummet

(Collapse.news) In keeping with falling financial markets in the world’s biggest economies – the U.S., Europe and China – American manufacturing is also taking a hit, as even adjusting economic figures seasonally, often used as an accounting trick by Uncle Sam to put lipstick on a pig, cannot hide the obvious.

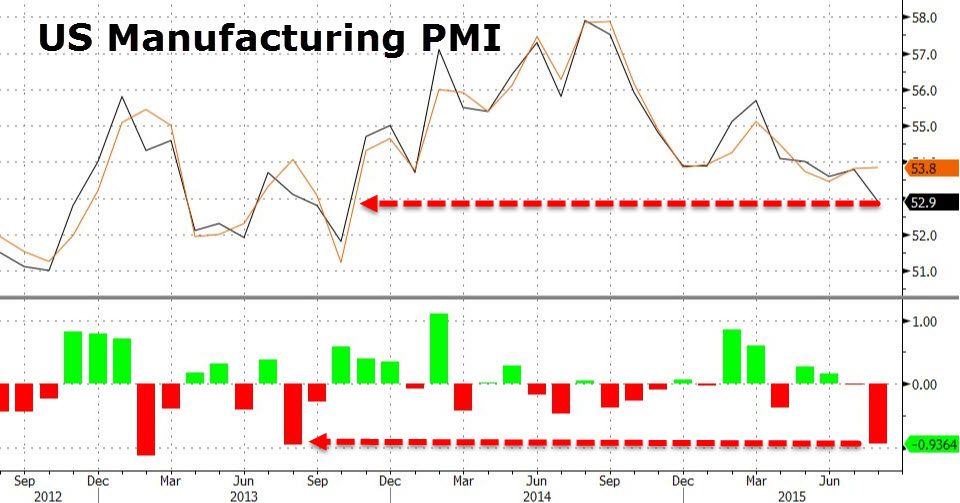

As reported by Zero Hedge, a few weeks after the July ISM (Institute for Supply Management) manufacturing report measured its lowest since March, the Markit manufacturing PMI (Purchasing Managers Index) was also released, coming in at just 52.9, below the expected index of 53.8 and down from last month’s 53.8, as you can see from the chart below.

“This was the lowest level since October 2013 and the biggest miss in exactly 2 years, with output, new orders and employment all expand at slower rates in August; Markit adds that ‘Input cost inflation picks up fractionally, but remains well below the survey average,’” Zero Hedge states.

Maybe it’s the weather again

In addition, the report says that the latest rise in production volumes was actually the weakest since a “weather-related” manufacturing slowdown in January 2014.

“Perhaps someone can blame it on the record hot July,” Zero Hedge wrote sardonically.

While some who responded in the survey blamed a cyclical slowdown in the growth of new businesses, along with increased uncertainty over the demand outlook in August, Zero Hedge notes that financial cable and network news broadcasters also cited experts who claimed that China’s yuan devaluation and productivity slowdown would not hurt U.S. markets (it has).

“Just chalk it up to the latest thing the economists were wrong about,” Zero Hedge wrote.

The financial news website also added:

Most notably, now that even highly subjective survey data can no longer be rigged to boost confidence, there is only one recourse: beg and plead for the Fed to not hike rates or better yet, as Bank of America did overnight, just hint that QE4 is just around the corner if the market crashes enough.

To that end, in commenting on the flash PMI data, Tim Moore, senior economist at Markit, said, “August’s survey highlights a lack of growth momentum and continued weak price pressures across the U.S. manufacturing sector, which adds some fuel to the dovish argument as policymakers weigh up tightening policy in September.”

Floor not yet reached

Continuing, Moore said that as the headline PMI loses ground quickly after a modest rebound in July, “the latest figure now points to the weakest overall pace of manufacturing growth for almost two years.”

Translation: Despite claims by the Obama Administration and his allies in the press and Congress, the economy might be doing well for the fattest of fat cats, but for ordinary folks, not so much – they aren’t buying enough to boost manufacturing growth.

“With the headline PMI swiftly losing ground after a modest rebound during July, the latest figure now points to the weakest overall pace of manufacturing growth for almost two years.

“According to survey respondents, the strong dollar continued to put pressure on export sales and competitiveness, while heightened global economic uncertainty appeared to have dampened client spending both at home and abroad,” Moore continued. “Alongside this, manufacturers of investment goods widely cited growth headwinds from the slump in capital spending across the energy sector.”

So, even as American consumer spending for big-ticket manufactured goods remains tepid, other sectors – like energy, especially (with oil prices collapsing) – around the world are tepid as well. Stocks in Europe’s over-leveraged economies as well as China have also been battered this week, and the floor hasn’t even been reached yet, say the most astute analysts.

“Sluggish manufacturing demand conditions and subdued cost pressures resulted in further restraint in terms of factory gate prices during August. Output charge inflation has broadly flatlined this summer and remains close to its lowest recorded by the survey over the past three years,” Moore said.

Why not QE4, then, asks Zero Hedge, since the earlier three sessions of quantitative easing have obviously not worked either?

Sources:

Tagged Under: Tags: global stocks, market collapse, Purchasing Managers Index, US manufacturing